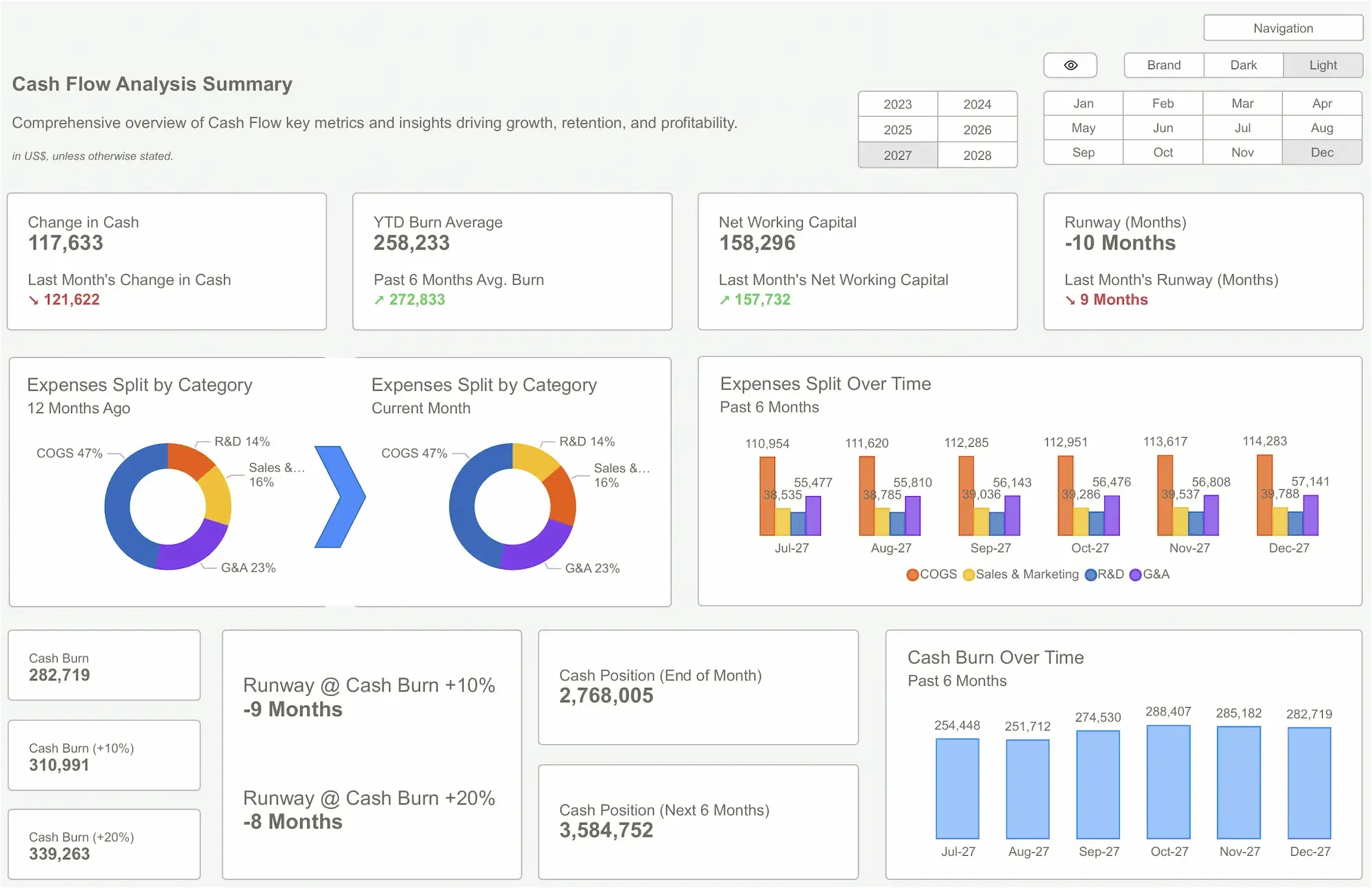

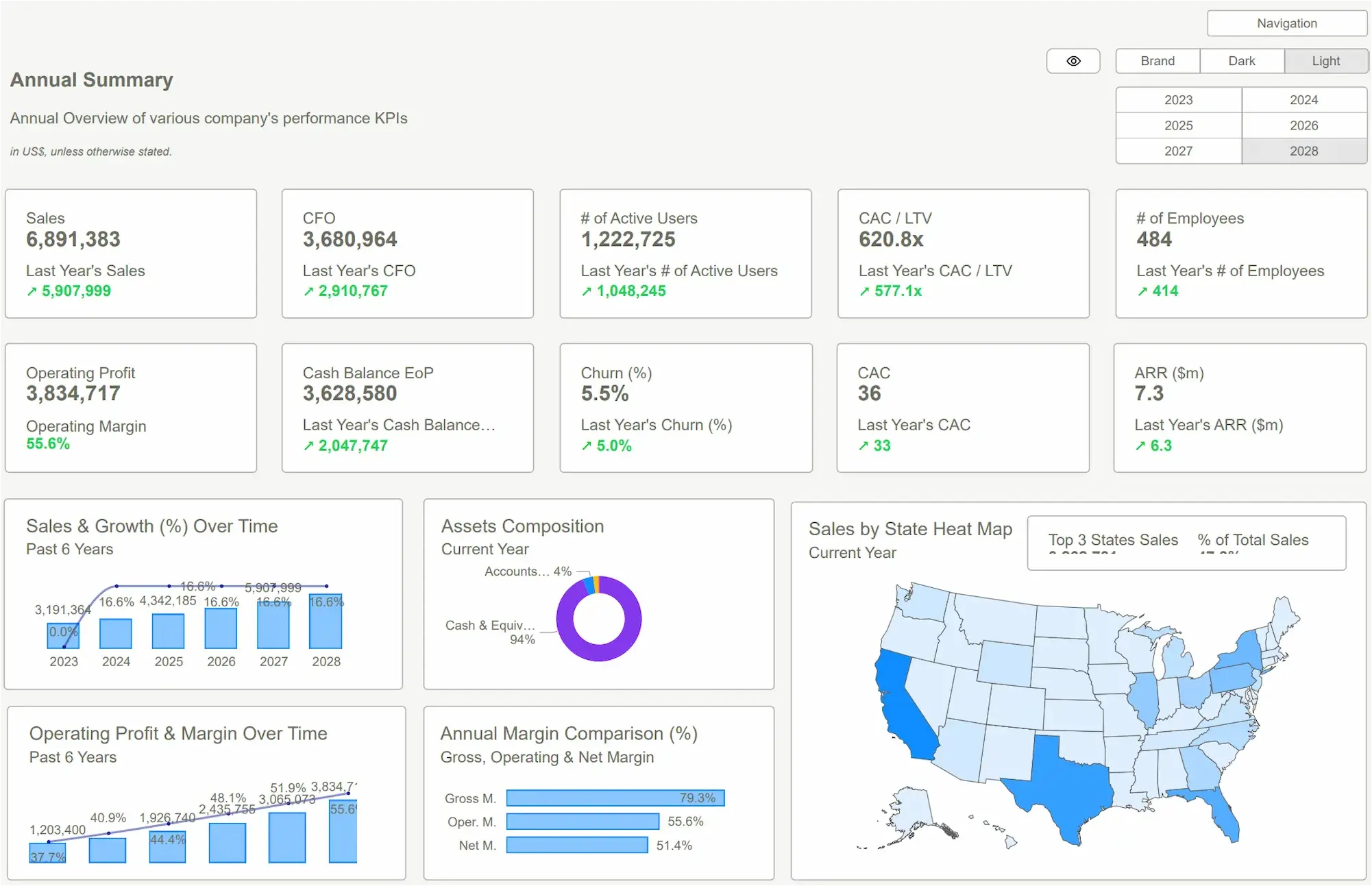

Most founders think they have a money problem. They don’t. They have a visibility problem. They stare at high-level dashboards, obsess over top-line revenue, and track their bank balance like a hawk, but they can’t explain why the burn rate feels so stubbornly high.

The term forensic accounting immediately brings to mind fraud, theft, and corporate scandal. You picture investigators in back rooms, digging for a smoking gun. For 99% of growth-stage companies, that’s a complete misconception. The real threat isn’t a malicious actor cooking the books; it’s a thousand tiny, invisible cuts draining your business of its lifeblood: cash.

This problem hides in plain sight. It’s the redundant SaaS subscription, the inefficient sales process, the overstaffed project, the miscalculated COGS. None of these are fraud. But added together, they create a silent, compounding drag on your company that can kill you just as surely as any market downturn. The goal isn’t to find a thief. It’s to turn on the lights.

Why Your Dashboards Are Lying to You

You’re trying to solve the problem, but your tools are failing you. The issue isn’t a lack of data; it’s a lack of truth. Here’s how it usually goes wrong:

- Process Decay: The scrappy processes that worked for 10 employees are now a chaotic mess at 50. What was once efficient is now a manual, error-prone workflow that eats up time and money. Nobody meant for it to happen, but every new hire inherits a slightly broken system.

- Tool Sprawl: Your tech stack looks like a SaaS graveyard. You have three tools that do roughly the same thing, you’re paying for 100 seats when you only need 60, and nobody has the access or knowledge to clean it up. Your finance team sees the total bill, but not the waste embedded within it.

- Mindset Mismatch: In the rush for growth, efficiency becomes a dirty word. The mantra is “grow at all costs,” but you forget to ask what those costs are. This mindset leads to undisciplined spending and a culture where questioning budget is seen as slowing things down.

Founders think the solution is a better dashboard. They hire a data analyst to build more charts in Tableau or Looker. But a dashboard only tells you what happened. It shows you that marketing spend is up and CAC is climbing. It doesn't tell you that you're burning 20% of your ad budget on a poorly configured campaign targeting the wrong audience.

That’s the core of it: You perceive the problem as a need for more data visualization. The actual problem is a lack of granular, operational inquiry. You don't need a prettier chart; you need an answer.

Forensic Accounting

Forensic AccountingThe Financial Autopsy: A New Way to See Your Business

To fix the bleed, you have to stop looking at the business like an executive and start looking at it like a coroner. You need to perform a financial autopsy—a deep, objective-driven investigation into the health of your operations.

Think of your business like a high-performance engine. Your dashboard is the speedometer; it tells you you’re going 80 mph. But you can hear a grinding noise, you’re getting terrible gas mileage, and there’s a faint smell of smoke. The speedometer is telling you a truth (your speed) but hiding a more important one (imminent engine failure).

A forensic-style review ignores the speedometer. It pops the hood and starts asking questions:

- Are the pistons firing correctly? (Are our sales team’s incentives aligned with profitability?)

- Is there a fuel leak? (Where is our SaaS and T&E spend actually going, line by line?)

- Is the engine oil clean? (Is our financial data accurate and reliable enough to even trust?)

This is our core philosophy: Data → Diagnosis → Decision.

Most companies are stuck at "Data." They collect it, chart it, and present it in meetings. We believe the real value comes from the next two steps. The Diagnosis phase is where the forensic mindset lives. It connects the financial data (the "what") to the operational reality (the "why"). Only then can you make a sharp, confident Decision that actually fixes the problem instead of just reporting on it.

Dashboards Don’t Make Decisions - You Do

Dashboards Don’t Make Decisions - You DoYou’re Not Being Robbed - But You Are Bleeding Money

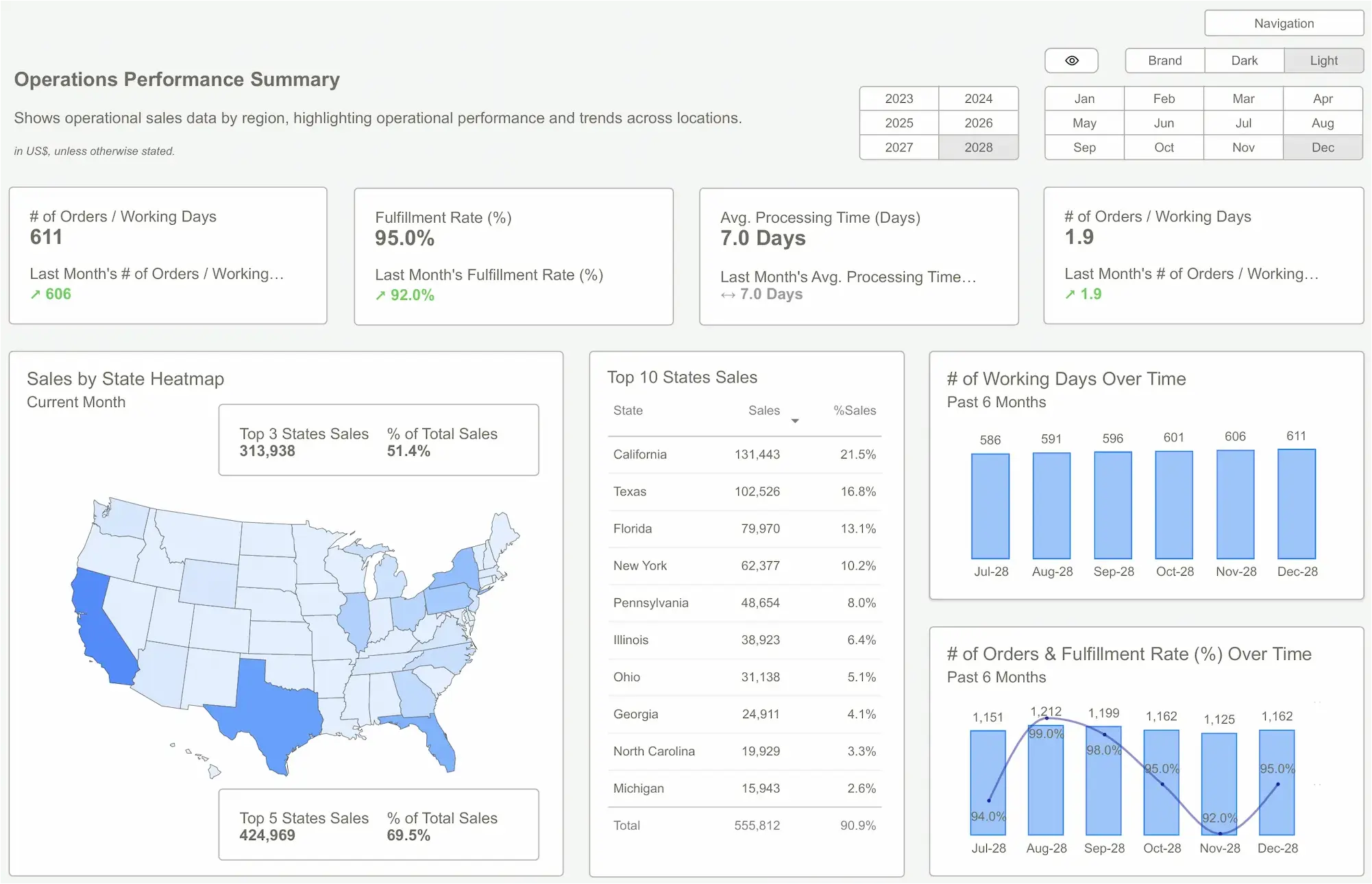

Moving from theory to practice, a forensic-style operational review is about asking brutally specific questions. It’s less about accounting rules and more about business logic.

Let’s compare the "before" and "after" states.

Before: The View from the Dashboard

- Finance says: “Our monthly software spend is $50k.”

- Sales says: “Our CAC is $5,000.”

- Ops says: “We fulfilled 1,000 orders this month.”

These statements are accurate, but useless. They are passive observations.

After: The View from a Forensic Review

- Finance finds: “Our monthly software spend is $50k, but $15k of that is from redundant tools and unused licenses. We can cut that tomorrow.”

- Sales finds: “Our blended CAC is $5,000, but it’s $1,500 for our core ICP and $12,000 for an experimental segment that never converts. We are burning 40% of our budget on a failed experiment.”

- Ops finds: “We fulfilled 1,000 orders, but our cost-per-shipment increased 18% because of a new packing process that is 3x slower. Reverting it will save $22k a month.”

This is the shift. You move from reporting metrics to pulling levers. This granular truth is the foundation for everything else. Your FP&A models become deadly accurate. Your data analytics initiatives have clean, reliable data to work with. You can even begin to explore AI for forecasting, because you’ve finally given it a source of truth to learn from.

A forensic review isn't a one-time cleanup. It’s how you build the operational discipline required to scale intelligently.

Data | EY – Forensic Data AnalyticsData Analytics Consulting

Data | EY – Forensic Data AnalyticsData Analytics ConsultingLet’s be direct. The reason you feel a constant sense of financial anxiety isn’t because you’re a bad operator. It’s because you’re making critical decisions based on incomplete, and often misleading, information. You don’t need more dashboards—you need a source of truth.

The modern application of forensic accounting for a growth-stage company is about surgically exposing operational waste and strategic blind spots. It’s about trading vanity metrics for verifiable unit economics. The result isn't just a lower burn rate; it's strategic clarity, operational control, and the ability to make faster, smarter decisions.

The cost of doing nothing is a slow bleed that drains your runway, frustrates your team, and erodes investor confidence. You can wait for the crisis—the cash crunch, the failed fundraise, the painful pivot—or you can find the inefficiencies now, while you still have the power to choose.

Don’t wait for the fire. Know where the smoke is coming from.

Still unsure? Send us your dashboard, and we’ll tell you what it’s not saying. We’ll show you where the questions are hiding.Get Started >

Ready to Unlock The Full Power of Clarity?

Explore our engagement options and pick the plan that fits your workflow.