Most companies look for savings in the wrong places. They cut headcount, freeze hiring, or renegotiate contracts once a year. But the real money leaks happen where no one’s looking: under the surface, buried in routine spend.

Forensic Accounting isn’t just about finding fraud. It’s about finding patterns—specifically, the slow, compounding inefficiencies that bleed your business dry without setting off alarms. The duplicate subscription. The auto-renewed tool that no one uses. The vendor whose unit price quietly increased 12% over three quarters.

This post is about using forensic accounting as a scalpel, not a hammer—to surgically extract waste and recover margin without layoffs or dramatic restructuring.

The Unseen Drain: Why Routine Spending Is So Dangerous

Every business has a version of this story:

- A SaaS tool was added for a single project. No one uses it anymore—but the monthly charge continues.

- A vendor quietly increases pricing by 2–3% each year, just below the radar.

- Two departments pay for the same software under different contracts—with different terms.

These aren’t one-offs. They’re patterns. And that’s exactly what forensic accounting is built to detect.

Routine spend becomes invisible. Once an expense is approved, it tends to recur unchallenged. That’s what makes it dangerous. It's not a one-time hit—it compounds quietly, month after month.

Forensic Accounting

Forensic AccountingWhere the Leaks Hide: Four Key Signals of Operational Waste

1. Pattern Analysis of Recurring Spend

Forensic accounting starts by categorizing every transaction over time. This reveals subscription creep, redundant tools, and underused vendors. When you track spend longitudinally, patterns emerge:

- SaaS creep: $29, $79, $249 tools that no one remembers approving.

- Marketing platforms duplicated across teams.

- Services renewed by default without usage reviews.

2. Price-Per-Unit Variance Across Departments

When departments negotiate separately, unit pricing drifts. One team may pay $12 per license, another $18, for the same tool. Forensic analysis normalizes cost and reveals inefficiencies:

- Office supplies with wide unit variance.

- Software licenses priced inconsistently.

- Travel and lodging booked without a standard.

3. Contract Leakage vs. Terms

Many vendors don’t bill exactly as agreed. Overages, unapproved add-ons, or changes in volume discounts go unnoticed. Forensic comparison of actuals vs. contract terms exposes these mismatches:

- “Overage” charges never matched to usage caps.

- Volume discounts that stopped applying after organizational shifts.

- Payment terms quietly shortened, eroding cash flow.

4. The Cost of “Set-and-Forget”

Some charges survive purely out of apathy or ambiguity. No one owns the expense. No one questions it. It’s “just always been there.” These costs can be shocking in aggregate:

- Old employee software logins still active.

- Tools used for now-abandoned projects.

- Unused Slack or Zoom seats billed annually.

Before You Scale, Forensically Audit Your Assumptions

Before You Scale, Forensically Audit Your AssumptionsThe Strategic Advantage of Operational Forensics

Unlike cost-cutting efforts that slash budget line items, forensic accounting doesn't reduce capability—it removes inefficiency. It uncovers savings without layoffs. It protects morale while improving margin. And perhaps most importantly—it builds discipline.

What this looks like in practice:

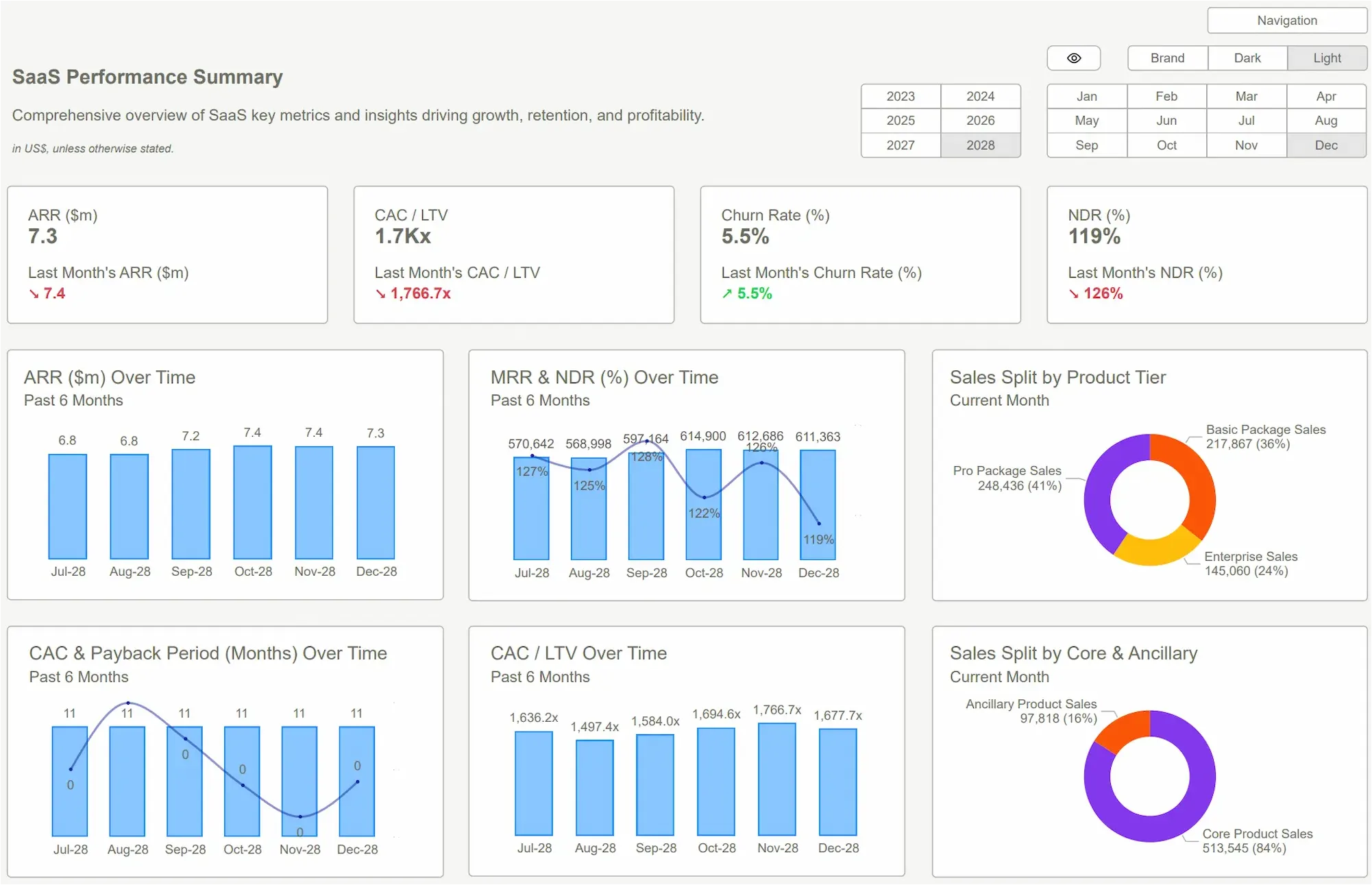

- A fintech company recovered $412K by consolidating SaaS spend across teams and cutting unused tools.

- A Series B startup regained six weeks of runway by identifying auto-renewed services and correcting vendor overbilling.

- A retail brand reduced churn after tying increased support costs to a “discount” logistics provider that failed on SLA targets.

This isn’t just savings—it’s strategic clarity. When your recurring spend reflects actual need and negotiated terms, your financial model becomes real. Not theoretical. Not padded. Real.

Accounting | Cube – Finance & Accounting AnalyticsFP&A

Accounting | Cube – Finance & Accounting AnalyticsFP&AIf you're leading a company through scale, the fastest way to recover margin isn't cutting jobs or selling harder—it's seeing your own spending clearly. And forensic accounting gives you that clarity.

Every dollar you recover from operational waste is a dollar that strengthens your margin, extends your runway, and reduces your dependence on the next fundraising round.

This isn’t about catching fraud. It’s about catching drift. Quiet, compounding, margin-killing drift.

If you haven’t looked at your recurring spend with a forensic lens, you’re not operating with full visibility.

Get in Touch → Contact No Black Swan for Expert GuidanceGet Started >

Ready to Unlock The Full Power of Clarity?

Explore our engagement options and pick the plan that fits your workflow.